How not Knowing ITR Filing Makes You a Rookie

Posted by Creditkaro

So, the big day is almost here. It is that time of the year again when the taxpayers of the country (all of us) must compile all the financial documents and file the income tax return. If you don’t know already all of us are divided into multiple categories and therefore have different slabs for filing the return.

The question is when is the big day? Did you know that the last date to file income tax return (ITR) varies for different categories of taxpayers?

Deadlines for various categories of taxpayers are as follows:

| Status of tax payer | Due Date |

| All individuals whose accounts are not required to be audited (individuals, HUFs, Association of persons, Body of individuals etc.)A company an individual or other entity whose accounts are required to be audited (proprietorship, firm etc.)A working partner of a firm an assesses who is required to furnish report under section 92E* | Extended till 31st august of the relevant assessment year. September 30th of the relevant of the assessment year. |

Assessment year (AY) refers to the year following the financial year in which income earned by you is assessed. This is the year in which you file your ITR for the financial year gone by. For instance, for the financial year 2018-19, the AY is 2019-20.

Now, for all the people who will file their respective ITR for the first time we will take you through the whole process so that you don’t feel like a rookie next time.

So, what is ITR?

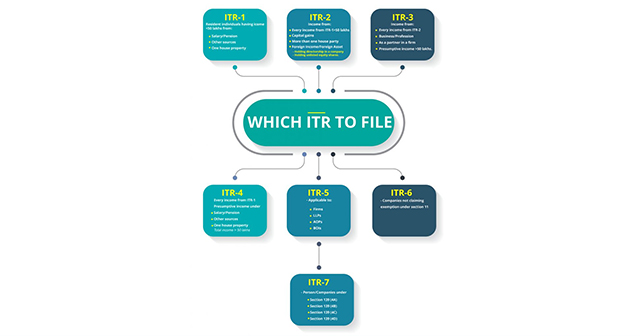

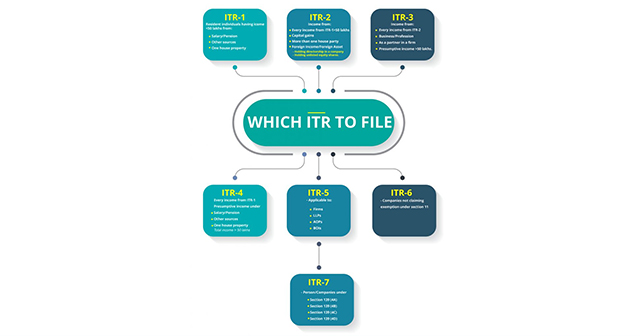

Income tax return (ITR) is a form in which taxpayers file information about their income earned and the tax applicable to the income tax department. Till date the income tax department has notified 7 various forms i.e. ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, ITR 7. Every taxpayer must file their ITR on or before the specified due date. The ITR form slabs varies depending on the sources of income of the taxpayer, the amount of income earned and the category the taxpayer belongs to individuals, HUF, company etc.

Yes. It is mandatory to file income tax returns (ITR) in India if any of the conditions mentioned below are applicable:

1. An Individual below 60 years whose gross annual income is more than INR 2.5 lacs

2. An individual above 60 years but below 80 years whose gross annual income is more than INR 3.0 lacs

3. An individual above 80 years whose gross annual income is more than INR 5.0 lacs

4. If an individual has more than one source of income like house property, capital gains etc.

5. If an individual wants to claim an income tax refund from the department.

6. If an individual has earned from or has invested in foreign assets during the financial year.

7. If you wish to apply for visa or a loan

8. If the taxpayer is a company or a firm, irrespective of profit or loss.

1. Form-16

2. Interest certificates from banks and post office.

3. Form-16A/Form-16B/Form-16C

4. Form 26A S

5. Tax-saving investment proofs

6. Documentary proofs to claim deductions under section 80D to 80U

7. Home loan statement from bank/NBFC

8. Capital gains

9. Pre-validation of bank account for ECS refund

10. Aadhaar card

11. Collect details of investment in unlisted shares

12. Collect bank account details

13. Update bank and post office savings account passbook, PPF account passbook

14. Salary slips

There are certain benefits that one can avail just by filing the ITR even if it may not be compulsory for some individuals.

Claiming refund-There is always a possibility that there has been tax deduction at source on some investment made in the name of the individual. So, If TDS has been deducted, then you will have to file the ITR to claim refund for the same.

Documentation-When you apply for loans , the quantum of loan and the eligibility will depend on one’s income which can be established through the filed ITRs because income tax return gives you a detailed picture of your gross income earned during a year and the tax paid on it, therefore these documents are used by various agencies for easier loan or visa processing.

Carry-forward losses –There are possibilities that you may have incurred losses in a year. At this point you cannot stay away from filing of your return saying you have an income below the exemption limit. In fact, you must ideally file your return so that you can carry forward the losses you have incurred to set it off against the income of the subsequent years.

Establishing Income proof-In cases where you have claimed for compensation , in such cases ITR can serve as an income proof .

Abiding the law-It is always advised to be on the right side of law and inform the income tax department about your income and taxability and it is only possible by filing ITR.

So, we hope that by now you know everything you need to know about filing ITR. As law abiding citizens it is our duty to file for taxes as the taxation structure is one of the primary pillars of our economy and all that we see around is a product of the taxes we’ve paid to the government. We hope that we were able to give you ample insight on ITR and the procedure to file. We love to bring you such interesting content because we stand behind you when life throws a doubt at you! We at credit Karo do a lot of background research to bring you the latest information on all kinds of financial news and products, we request you to read it and suggest anything that we have missed out on or anything that we should do a blog about. Till then, keep coming back to us at

Category

Recent Post

Archive