History Of The Credit Card And Its Evolution

Posted by Creditkaro

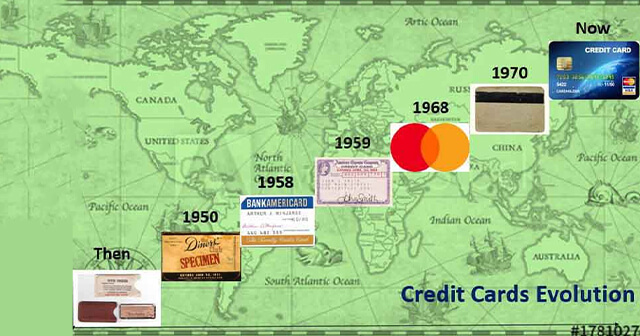

The world as we know today has transformed so much in terms of using currency that we barely need to use the paper. Credit Cards are the gamechangers in the digital world today with the introduction of various commercial apps where we can make digital payments within seconds with help of our credit Cards. Today we have the flexibility of making transactions online with our cards at the comfort of our home, which clearly shows us a huge contrast from the 50’s. The way the card has evolved from metal to Cardboard or paper like celluloid to the PVC plastic clearly goes on to show how we have made the world very small place to live in.

Before the evolution of credit cards there were many different modes of making payments and taking credit, as we moved forward from one decade to another the form of taking credit and making transactions evolved.

Before the existence of credit cards, large-scale merchants, their regular customers, business elites and wholesalers used credit coins and charge plates to deal in goods and services on credit. Charge plates made of aluminum or white metal were used in departmental stores. These plates had customer’s name and address listed on it and were popularly known as ‘Charga-plates’.

Charge coins were first introduced around 1865. The first coins were made of paper like celluloid then later as time went by, copper, steel, aluminum or white metal were used. These coins were usually made in unique shapes and sizes. Some were triangular, others were round. These credit coins were issued by departmental stores and displayed the customer’s identification number and trademark of the merchant.

In the year 1946 a Brooklyn banker named JOHN BIGGINS working for the Flatbush National bank introduced to the world the first “credit card” ever issued by a bank which went on to revolutionize the world and changed the way people used money and any other form of credit. The concept of the new charge-it card was such that the bank would pay the local stores on behalf of card holders and accept responsibility of collecting the debt from them and that is how the universal card was invented that we know and use today.

THE FIRST SUPPER

Year 1949, Frank McNamara, a well-known executive of Hamilton credit corporation was having dinner with a business associate. In a Manhattan restaurant when it was time for the bill, he realized that he forgot to bring cash. By the time his wife arrived with money, the bill was already settled. It was then when Frank was led to the idea of using charge cards at restaurants. McNamara convinced many restaurants in Manhattan to sign up. for the card and offered them a 10 percent discount for every store purchase. Many salesmen signed up as there was no fee and it was easier to purchase food without cash. so eventually it would attract more customers. Therefore, the idea of the “Diners Club” was born and gave the world a brand-new industry in the world of best credit cards.

For the very first time in the 20th century PVC plastic was used to replace. The usual cardboard or thin paper celluloid by the ‘AMERICAN EXPRESS COMPANY’. This first plastic card was used as a charge card which required payments in full at the end of the month. And interest amount was added against the credit.

Year 1951, a New York financial institution named “Franklin National Bank” issues charge cards to its loan customers. It was only available to Franklin’s account holders and was somewhat like the Charge-it card.

Year 1955, First US patent is granted to the phrase “CREDIT CARD” to a trio. Who invented the first gas pump that could accept credit cards.

Year 1958, BANKAMERICARD sends out 60,000 credit cards to unknown customers in California in their mail. This card could be used to make any kind of purchases at stores. Which accepted this form of payment and eventually went on to become the first revolving program.

Year 1966, Bank of America starts licensing its credit cards across the United states. Around 60,000 banks all over the U.S. started accepting the BANKAMERICARD. It becomes the first general purpose credit card to get licensed across the country.

Year 1966, a Committee of banks in California came together to form an association. To create the first national credit card system in the country. Which then created rules and regulations to be followed and a standard system. So that would be followed for the processing of payments made by users.

Year 1968, banks in Japan, Mexico and Europe came together. With the Interbank association to form a global market for credit cards. This association then goes on to change their name to ‘MASTER CARD’.

Year 1970, IBM unveils the magnetic strip, which could store the credit card’s data at O’Hare airport. In Chicago in a pilot project with American express and American airlines. Due to the increase in credit card fraud in the 60s.

BANKAMERICARD changes its name to ‘VISA’ to reflect on its global reach around other countries in the year 1976.

Since the inception of VISA and Mastercard the credit card has evolved immensely. In terms of material used, design, number of cards, usage, offers and reward points and moreover availability. There are so many online merchants in today’s market. One can easily transfer money using their credit cards within a matter of seconds.

New inventions will take place in future and maybe we’ll see a more futuristic design. This amazing product but what we truly need to appreciate. Here is the way we have combined luxury with convenience and technology.

We at creditkaro, try to bring you more such interactive blogs to read. So that it becomes fun to scroll through our pages. Where you get to know about all kinds of financial products in a fun way. We are eager to know how you feel after reading our blogs. What do you think we missed out on. So, we invite your valuable suggestions on our website. And more importantly our content so feel free go through and comment. So that we can work on making your every experience better than the previous one. Check the top 10 Best Credit Card in India.

Category

Recent Post

Archive