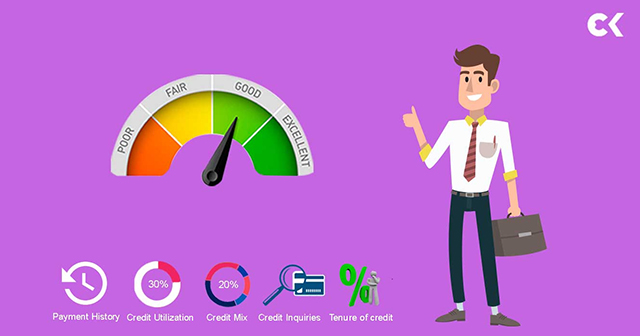

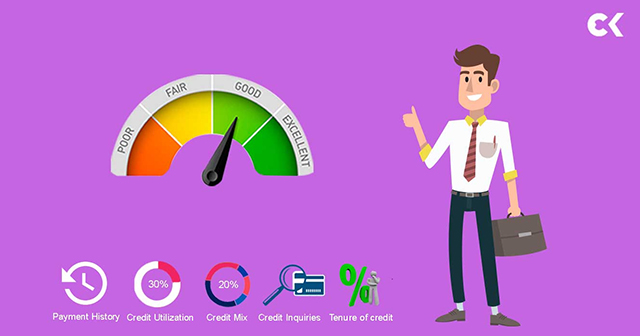

Factors that can boost your credit score!

Posted by Creditkaro

Using credit cards has become so common and essential today that sometimes you can’t do without it. People have become so used to it that they prefer using a credit card for making any kind of expense rather than their own money. The credit card industry has seen massive growth in the last two decades. And there is no doubt about the fact that the demand will only go up and not vice versa.

Since the inception of credit rating agencies, free credit score check in India has been a mystery that average people have failed to crack. At times you may feel that you need to do a diploma course to understand the whole structure. But in reality, it is no rocket science and is very easy to break down. There is a possibility, you might doubt your skills after reading this blog, and if you already know about the hacks, you don’t need to read this, you can check some other cool blogs we have done!

Better chances of getting approved for credit cards and loans

More negotiating power

Get approved for higher limits

Lower interest ratesSince the inception of credit rating agencies, the logic to check credit score has become a mystery that average people have failed to crack. At times you may feel that you need to do a diploma course to understand the whole structure, but it is no rocket science and is very easy to break down. There is a possibility, you might doubt your skills after reading this blog, and if you already know about the hacks, you don’t need to read this, you can check some other cool blogs we have done or check free credit score here! Remember, you can always check your credit score online with us. So, people who have a weak heart when it comes to bills can brace themselves as we bring you a few easy hacks to maintain a good credit score.

The first and foremost thing that matters is your payment history. You must make sure that you do not fall behind pay dates because every late payment has a negative impact. On your score which pushes you behind. The lenders(bank) feel secure when you make timely payments. They want to make sure that you will pay back the amount lent to you on time. This is a major factor while credit score check.

Each month you are given an available credit limit and a utilization ratio is calculated by dividing your current total. Revolving credit by a total of all your revolving credit limits (source: Experian). This ratio gives an idea about how much of your available credit are you using. And how much dependent are you on credit funds. Spending more than 30% of your available credit has a negative impact on creditors according to Experian.

It is always advised to have a diverse portfolio of credit accounts. This is an important aspect of consideration for credit scoring models. It is important for the creditors to know how many types of accounts you have had in the past and how you have managed them.

Every time you place a request that requires a credit check. It will place an inquiry on your credit report. One or two enquirers will not take away anything from your credit score but several hard inquiries in a short period of time can result in a drop in your credit score.

The tenure of credit history is also a major factor that can boost or drop your score. Having an older credit account is better as it shows that you have taken credit in the past. And have the experience of managing credit. Opening and closing multiple new accounts in a short span of time can result in a drop in your credit score.

Till then…happy buying!

Now you can also check your credit score on the creditKaro app! Click on the link below to download the app now!

Category

Recent Post

Archive