Best Rewards Credit Cards Mar 2021

Posted by Creditkaro

Credit Cards have become very important in our day to day lives these days. They are more accessible compared to before and we can apply online for them. The only question that remains is which card to apply for and which is the best card suited for us. We have divided credit cards into different categories namely Rewards, Cashback, Fuel, Travel and Shopping which makes it easier to shortlist the card you want. Today we are going to talk about the best reward credit cards online. If you want to apply for rewards credit cards, click here.

<a class="btn btn-info" href="https://www.creditkaro.com/credit-card">Credit Card Apply Online</a>

Credit Card Apply Online

Reward points on purchases made with credit Card

Credit Cards focused on Reward Points are popular these days as they provide users with reward points with every purchase which they can use further for doing more purchases of their choice from thousands of options. The more you spend, the more you can earn is the motto for Rewards Credit Cards. However, it is very important to set limits on your spending, be regular with your payments and never ever forget to read the fine print. For those who want a card more focused on Reward Points, don’t look any further. We have created a list of best Rewards Credit Cards with extensive research and personal experience.

Top 8 Rewards Credit Cards Jan 2021 in India are:

Citibank Rewards Credit Card

American Express Gold Card

Standard Chartered Platinum Rewards Credit Card

SBI SimplyCLICK Credit Card

American Express Membership Reward Card

RBL Bank Platinum Maxima Credit Card

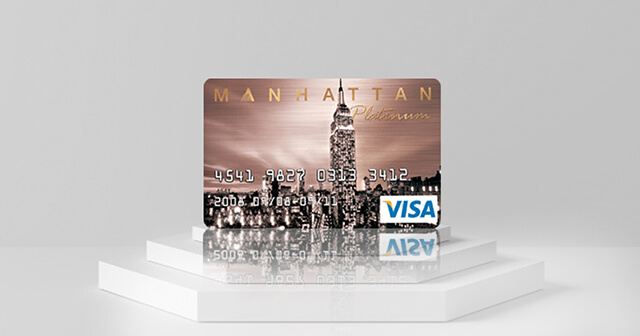

Standard Chartered Manhattan Platinum Credit Card

HDFC Bank Titanium Times Card

Before delving any further details on Rewards Credit Cards, we would emphasize on the fact that the most important criteria for getting a Credit Card is your Credit Score. Credit Score ranges between 300 to 900 – the higher the better and a score above 750 is considered a good score and banks would approve the loan if you have a score above 750. You can check your Credit Score before applying for a loan by clicking here

Now that Credit Score is covered, let’s look at each of the cards and understand what Rewards they offer and what are their best features.

<a class="btn btn-info" href="https://www.creditkaro.com/credit-score">Check Free Credit Score</a>

Citibank Rewards Credit Card is one of the best Rewards Card available in India. It comes without a joining fee and has an annual fee of INR 1000 which can be waived off if you spend more than INR 30000 during the year.

| Joining Fee: | 0 |

| Annual Fee: | 1000* |

| Income Eligibility: | 6 lac per annum onwards |

You can earn 10 Reward points for every INR 125 spent on Apparel & Department stores

Earn 1 Point for every INR 125 on all other purchases

These Reward points come with a lifetime validity which you can use while shopping at over 700 outlets and online shopping sites.

You can also earn up to 2500 Rewards Points after card activation – 1500 points upon first spend made within 30 days of card issue & additional 1000 points upon first spend of INR 1000 within 60 days of the card being used.

American Express Gold Card has income eligibility of INR 50000 per month. This is a very good card if you are a frequent shopper.

| Joining Fee: | 1000 |

| Annual Fee: | 4500 |

| Income Eligibility: | 6 lac per annum onwards |

With this card, you get 4000 Bonus Membership Reward points as welcome gift

You also earn 1 membership reward point for every INR 50 spent except on Insurance, Fuel, Cash and utilities.

You will also get 1000 Membership Reward points on completing 6 transactions of INR 1000 with your card.

Cardholders also get 5000 Membership Reward Points on Annual Renewal of card.

With Standard Chartered Platinum Rewards Credit Card, cardholders get a variety of Reward points options with no monthly cap.

| Joining Fee: | 0 |

| Annual Fee: | 750 |

| Income Eligibility: | 6 lac per annum onwards |

Customers get 5 Reward points for dining and fuel for every INR 150 spent

Earn 1 Reward point for every 150 spent on everything else.

These Reward points can be used to avail a host of offers and discounts across shopping, dining and travel.

Another major feature of this card is 20% cashback on UBER rides which is a major plus point for frequent cab users

SBI SimplyCLICK Credit Card is a good Rewards category Credit Card from State Bank of India. This card is a widely accepted card and can be used at 24 million outlets across the world.

| Joining Fee: | 499 |

| Annual Fee: | 499 |

| Income Eligibility: | 6 lac per annum onwards |

You get 10X Reward points on online spends with exclusive partners

5X Reward points on all other online spends.

Some other offers that can be availed with this card are Amazon Gift card worth INR 500 upon joining, 100 cashback instantly on first movie ticket booked on BookMyShow

INR 600 off on booking Zoomcar for an amount of INR 2500.

American Express Membership Reward Card comes with 4000 Reward Points upon joining.

| Joining Fee: | 1000 |

| Annual Fee: | 4500 |

| Income Eligibility: | INR 50000 pm onwards |

With this card, you can earn 1000 Reward points on four transactions in a month.

In addition to this, customers will earn 1 Membership Reward Point on every INR 50 spent except for Fuel, Insurance, Utilities and Cash transactions.

This card is equipped with contactless payments

Get exciting offers on Makemytrip bookings

This is another good Rewards Card from the kitty of RBL Bank

| Joining Fee: | 2000 |

| Annual Fee: | 2000 |

| Income Eligibility: | 6 lac per annum onwards |

You get 8000 Reward Points as welcome gift with this Card

And an additional whooping 20000 Bonus Points on spending more than 3.5 lacs in a year

This card enables customers to earn 10 Reward Points for every INR 100 spent on dining, entertainment, fuel, utlilities and international spends

For every other purchase, they get 2 Reward Points

Customers also get 2 free access at all major domestic airport lounges in India

In addition to this, one free movie ticket worth INR 200 from Bookmyshow is provided every month

Although the charges for this card are on higher side with Joining Fee and Annual Fee being INR 2000, the benefits and Reward Points make it worth buying this card.

With a Joining Fee of 499 and Annual Fee of 999, this card is a good steal as if offers innumerable offers and discounts across shopping, travel and dining.

| Joining Fee: | 499 |

| Annual Fee: | 999 |

| Income Eligibility: | 8 lac per annum onwards |

Standard Chartered Manhattan Platinum Credit Card provides customers with 5% cashback at Supermarkets

Users get 3X Reward points for all other spends

You also get Bookmyshow vouchers worth INR 2000 upon activation

If you are a foodie and love to eat out, this is the perfect card for you.

| Joining Fee: | 500 |

| Annual Fee: | 500 |

| Income Eligibility: | 8 lac per annum onwards |

With this card, customers earn 5 Reward points for every INR 150 spent on Dining on weekdays

For every other purchase or spend, 2 Reward points are earned.

In addition to this, cardholders will get 25% Off on movie ticket bookings and up to 15% off on participating Dining outlets

Get your own Rewards Credit Card now and enjoy a host of offers, discounts and Rewards on all your spends!!

Category

Recent Post

Archive